RISE and GROW: perfect for SAP

When SAP announced their RISE for SAP offering, I a stated that this is a good idea for SAP. It allows SAP to get a seat at the table when their customers are discussing their transformation roadmap with their partners. A scenario where customers define their future landscape and SAP is seen in a supporting role. Asked to join in an already advanced stage of planning. Here SAP can use RISE to not only sell licenses and basic support, but can use their RISE offering to influence customer’s decisions. To not let this strategic decision be decided almost entirely without them. I also wrote that the offering could offer value for all, but that RISE is made by and for SAP, and that this bears risks for customers and specifically, for partners. Some years passed and what I wrote back than seems to come to reality.

“Looking at the offer, I see 70% win for SAP, partners 20% and customer 10%. SAP RISE is a game changer for SAP, not necessarily for customers and partners. Short: SAP RISE is an offer made by SAP because they need it.„

SAP RISE

SAP is pushing RISE/GROW with SAP (going to use only RISE from now on to make the writing easier) aggressively. SAP focuses on the word cloud to push customers to buy their offering. Customer wants S/4HANA? Via RISE SAP offers S/4HANA on cloud: S/4HANA public cloud and S/4HANA private cloud. The word cloud triggers everyone to believe that SAP offers a real cloud version of S/4HANA. But what people understand as cloud, you only get with S/4HANA public cloud. That is the real SaaS offering of S/4HANA: the ERP system is shared with other customers and the options to customize / adopt the system are very limited. That’s the difference also to the S/4HANA private cloud edition: many customer customization features are stripped down to the bare minimum. All to ensure that SAP can update the system without having to wait for a customer to adjust custom coding. Customers get new features faster via public cloud, but was being an early adopter of new SAP features ever a good reason? The S/4HANA private cloud however is misunderstood many times as a cloud offering. It is just a deployment option for an S/4HANA on premise edition. It is cloud because it is deployed to a hyper scaler and operated by SAP. The difference between an on-premise S/4HANA system and a private cloud one? Nothing. Same coding, same software, same possibilities. In case the current on-premise S/4HANA system is already deployed to a hyper scaler like e.g. Azure, this is as close to private cloud as inserting the word private cloud gets. With S/4HANA public cloud customers get features earlier and do not have to wait until the feature is available for the on premise or private cloud. For the big S/4HANA customers it is nice that smaller companies fill in voluntarily the role of the beta tester.

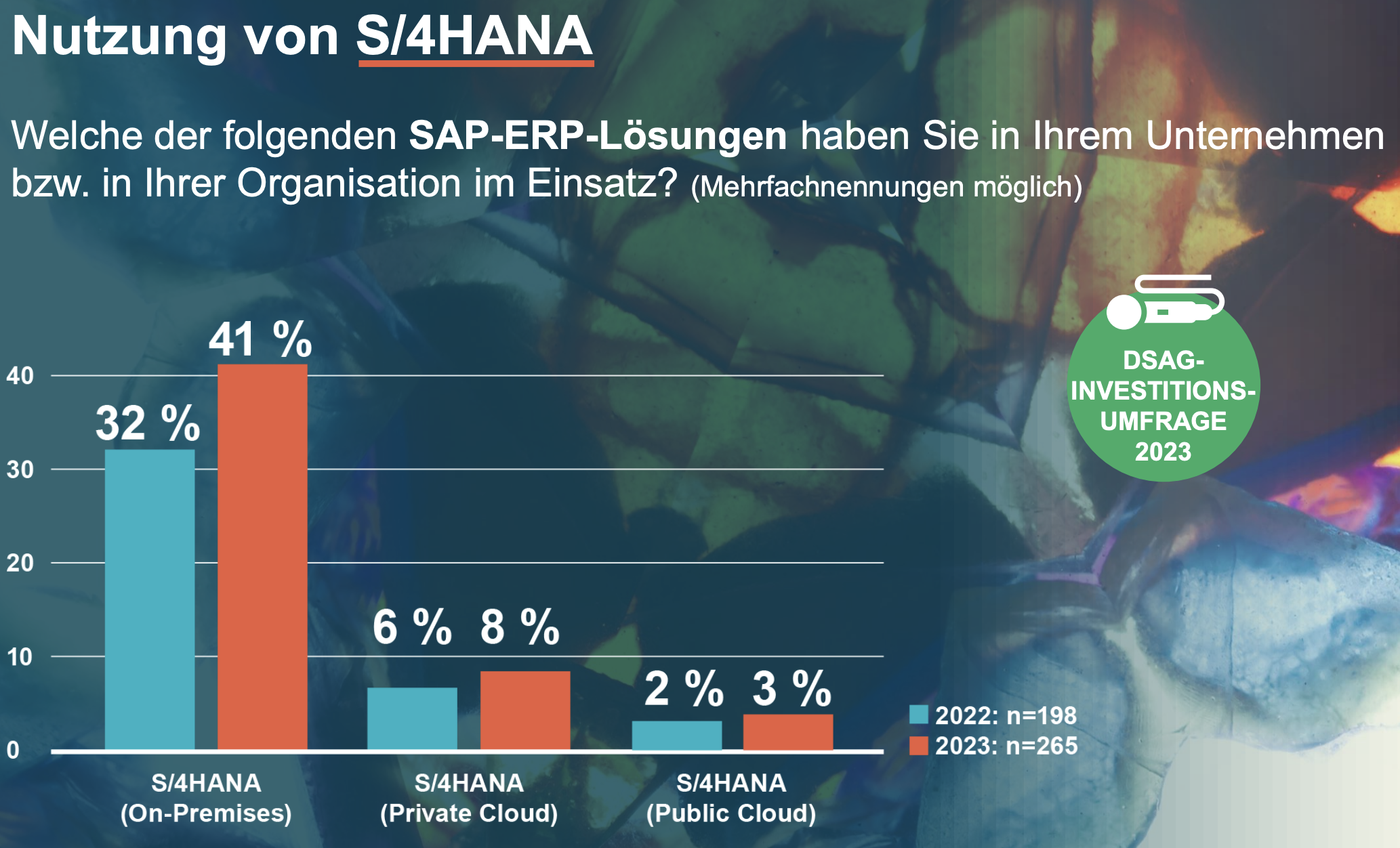

SAP RISE allows SAP to put focus on cloud, to have an offering that they can sell. Yet, with all the focus on RISE, is it paying off? There is a picture from a Gartner analysis on Twitter that speaks for itself: S/4HANA adoption in general could be better. 14% of the existing ECC customers is already on S/4HANA. 86% is still missing in action. At the DSAG Keynote a survey result was shown indicating that only 11% are using S/4HANA cloud public/private.

The majority is using the on-premise version. This might serve as an indication whether RISE is a success. Hints from the market also indicate that RISE might be behind expectations.

3 years after SAP started with RISE, I hardly can imagine that the numbers are what SAP expected. RISE seems to have good traction for small companies that go to S/4HANA public cloud and where a high level of standard processes is simply mandatory. Short: for new customers that have no big legacy footprint, nor a trusted partner, SAP RISE is a success. These companies do not always have the skills to customize their system at all. But they are not what is normally understood as an SAP customer and could have lived happily with Business One or Business ByDesign. I do not know the numbers, but my guess is that a customer must bring 100+ users to S/4HANA public cloud and extend it via BTP or other solutions from SAP to bring enough revenue to make it a good deal.

Summary so far: RISE is an offering to boost SAP sales. S/4HANA public/private cloud lacks adoption. And the customers that push the numbers, are “small” companies.

DSAG annual conference

With this in mind, lets take a look at the DSAG Jahreskongress 2023 keynote. Christian Klein (SAP CEO) talked about change.

The content he presented was about the offering RISE for SAP and why innovations are delivered for cloud and – of course- why this is good for customers. The keynote was a sales event for RISE. Given the results presented at the DSAG keynote previously, maybe this was not the best set up. The presentation, and to some degree also how Klein presented it, did not make a good impression. At previous DSAG keynotes, the following SAP speakers were rarely reacting to the facts presented in the keynote before. This was here also the case.

SAP Keynote

Klein gave some reasons why to use cloud and RISE. Most points were from the SAP perspective. Cloud is not new. It changed business. Other companies were able to complete their transformation and are now (mostly) cloud. RISE is a vision that SAP came up with for customers. Not explicitly mentioned, but between the lines: to save SAP. To bring SAP to the cloud.

Klein did everything to align SAP to the vision. Cloud, BTP, open architecture via interfaces for SAP and non-SAP. Heavy investment into research. Automation, AI, intelligent process, etc. Why does SAP think RISE is great, why go to cloud, why use their offering. SAP offers AI, it is in use by 25.000 customers (I still wonder who? And do they know they do?) and secure. For sure, the vision is good, coherent. But: nothing new.

There is the no one left behind promise. This doesn’t mean that customers can stay on an older release. They must upgrade to S/4HANA. They can stay on premise. But that choice will come with less features. That Klein does not like this scenario was clear in his speech: SAP will invest that these customers are not left behind. Because they have to. An example he gave was BTP. BTP will continue to be ported to the main 3 hyperscalers. This is sold as an act of mercy, like: SAP is doing this for you customer. This ignores the fact that SAP must do this because SAP is not a hyperscaler. In that cloud business, they are irrelevant. AWS, Azure, GCP, those are hyperscalers. SAP not. SAP tried, failed, now they must pay the price for not being a hyperscaler. Offering BTP in 3 clouds is not an offer that SAP makes to customers voluntarily. SAP must do this. The audacy to expect a “thank you SAP” from customers. The list of things customers can expect to be available for everyone is long. Yet, SAP wants to offer those only to SAP RISE customers. At least for S/4HANA private cloud, this makes no sense. It is the same as an on premise S/4HANA. Why not let customers subscribe to the cloud feature like AI and integrate it into their on premise system? Basically the same as for private cloud?

Conclusion

No new reasons why SAP RISE is the best thing since sliced bread. Au contraire.

Why should a customer use SAP’s AI? And when they want to, why only via SAP RISE and why does it still cost an additional 30%? Is SAP secure? Can SAP be trusted that it treats customer data securely? (hint: I am not convinced) SAP customers have complex systems. That’s where SAP should offer support, and not blame customers that they have a complex system. What is the intention to always say: there is customer with a huge legacy SAP system, with lots of customization, and they have to spent now millions for a brownfied migration to S/4HANA. Their fault that it costs time and money with little benefit. That was the tone of the keynote: blaming customers that they do not understand how great SAP’ offering is. Or that they allowed to have a complex landscape which makes SAP’S life hard. Welcome to reality. How about making it as easy as possible for the customer base to got to S/4HANA instead of making it even harder?

RISE is 3 years old, a brainchild of Klein, but why are customers not using it? The why is important, but Klein skipped talking about this. No analysis or adjustment to RISE to ensure that adoption grows by eliminating key pain points. Is it better adopted outside DACH region? Large, medium or small enterprises? If so: why? Instead, an accusation. Why does he have to justify it? Can’t customers simply see how great it is?

Always good to see a CEO blame customers for not buying into a vision and offering. I have no clue if Klein was nervous or if he is under pressure from the board or stakeholders. But how he handled the presentation … dificult. Do the numbers not match expectations? Sales numbers? Stock price? Customer satisfaction? SAP has some experience when it comes to CEO’s that act against the interest of SAP customers. Normally this does not end very well for the CEO.

0 Comments